|

| El barco fue detenido en febrero pasado en un puerto de Cartagena. |

CONTRA EL PINGALISMO CASTRISTA/ "Se que no existe el consuelo que no existe la anhelada tierrra de mis suenos ni la desgarrada vision de nuestros heroes. Pero te seguimos buscando, patria,..." - Reinaldo Arenas

miércoles, abril 22, 2015

Colombia autoriza a zarpar hacia Cuba a barco chino con armas

miércoles, marzo 04, 2015

Barco chino con armas para Cuba declaró que transportaba cereales

|

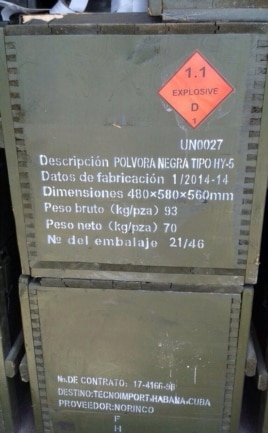

| Fotografía cedida por la Fiscalía de Colombia donde se ve un contenedor incautado por las autoridades colombianas con armamento en su interior. |

El registro de ruta, de acuerdo con fuentes oficiales, era la isla de Cuba. Agregaba que Antinarcóticos, la Armada y hasta la Fiscalía recibieron información sobre la presencia de la carga militar en el buque, luego que este llegara a Cartagena a fin de desembarcar tubos para una firma petrolera.

¿Incidente inoportuno?

|

| Durante el registro, las autoridades "encontraron alrededor de 100 toneladas de pólvora, unos 2.6 millones de fulminantes, 99 núcleos de proyectil y alrededor de 3.000 casquillos de referencia para la construcción de cañones de artillería". |

lunes, marzo 02, 2015

Breaking news: Colombia detiene buque chino con armas para Cuba

|

| El barco chino con armas para Cuba detenido en Colombia sería el Da Dan Xia, según vesseltracker.com |

El comandante del buque se opuso en un principio a la inspección, pero la falta de documentación obligó a que la diligencia se realizara.

Al indagar oficialmente por el tema, fuentes oficiales dijeron que el caso está siendo tratado por el Ministerio de Defensa.

domingo, diciembre 14, 2014

De las aletas de tiburón y otras comidas chinas de Fidel Castro

lunes, septiembre 08, 2014

¿Las empresas cubanas a la bolsa de Hong Kong?

Cuba: Constituyen segunda empresa mixta en sector inmobiliario

miércoles, agosto 13, 2014

China Appears Ready to Dump Its U.S. Treasury Bonds

Although investors hang on every comment by Federal Reserve Chairwoman Janet Yellen to get insight on the direction of interest rates and what it means for the economy and asset prices, the real power to determine U.S. interest rates may be in the hands of China, according to Lombard Street Research. Facing an overvalued currency that is hurting corporate profits and slowing growth, China appears ready to dump its $1.3 trillion in U.S. Treasury bonds to drive U.S. interest rates up and strengthen the dollar.

domingo, marzo 23, 2014

Cuba: Atrasos en obras y pago a trabajadores de terminal del Mariel

|

| Terminal de Contenedores en construcción |

viernes, diciembre 27, 2013

Chinese automaker Geely planning assembly in Cuba

|

| Geely stand at the International Havana Fair (FIHAV) |

jueves, octubre 31, 2013

Aumenta un 25% comercio entre Cuba y China

martes, octubre 08, 2013

Empresa china suministra equipos al Puerto de Miami y al Puerto del Mariel en CUBA

martes, junio 18, 2013

viernes, junio 07, 2013

The Economist: Why has China snubbed Cuba and Venezuela?

The short answer is: for simplicity’s sake. Visits to Cuba and Venezuela might well have raised distracting questions when Mr Xi meets Barack Obama in Southern California on June 7th, and neither socialist government was likely to express publicly any offence at being left off the itinerary. The beauty of having a chequebook as thick as China’s is that if you give your friends the cold shoulder, you can always mollify them with money. That may be why, on June 6th, Venezuela’s oil minister announced that he had secured an extra $4 billion from China to drill for oil, in addition to $35 billion already provided by Beijing. Not quite in the same league, but significant nonetheless, the Havana Times reported this week that China was also planning to invest in Cuban golf courses, the island’s latest fad.

However, as our story on Mr Xi’s visit to Latin America points out, he may have had other reasons for picking the destinations that he did. Firstly, he may be trying to respond to Mr Obama’s “pivot” to Asia by showing that China is developing its own sphere of influence in America’s backyard. China’s business relationship with Latin America gets less attention than its dealings with Africa, but in terms of investment, it is much bigger. According to Enrique Dussel, a China expert at Mexico’s National Autonomous University, Latin America and the Caribbean were collectively the second largest recipient of Chinese foreign direct investment between 2000-2011, after Hong Kong. In terms of funding, Kevin Gallagher of Boston University says China has provided more loans to Latin America since 2005 than the World Bank and the Inter-American Development Bank combined. The visits to Mexico and Costa Rica may also represent a pivot of sorts in terms of the type of economic relationship China has with Latin America. Up until now, China has hoovered up the region’s commodities, importing soya, copper, iron, oil and other raw materials, particularly from Brazil, Chile and Venezuela, while flooding the region with its manufactured goods. But its relations with Mexico, a rival in low-cost manufacturing, have been frosty: China accounts for only about 0.05% of Mexican foreign direct investment, and it exports ten times as much to Mexico as it imports.

But as wages in China have increased and high energy prices have raised the cost of shipping goods from China to America, Beijing may be looking for bases such as Mexico and Costa Rica where it can relocate Chinese factories and benefit from free-trade agreements with the United States. This idea thrills the Mexican government, but does it pose an immediate threat to Venezuela and Cuba? Probably not: China will continue to need their staunch ideological support over issues like Taiwan, for one thing. But it does suggest that China’s economic interest in the region is broadening, especially along the Pacific coast. If that proves to be the case, Cuba and Venezuela, deprived of the charismatic Chávez to court Beijing on their behalf, will have to work hard to stay relevant.

lunes, mayo 27, 2013

Cuba iniciará las pruebas para introducir progresivamente la televisión digital

viernes, mayo 03, 2013

miércoles, abril 24, 2013

Chinos con identidad de cubanos en camino a EE UU

|

| www.ojeas.com |

La guerra de los diez años sorprendió a estos migrantes en Cuba y se sumaron a las huestes libertadoras. Muchos de ellos se mezclaron con españoles, con negros y hasta con mulatos. De ahí nació el chino-cubano.

Las relaciones entre los gobiernos de Cuba y China se han mantenido por años con más bajas que altas; pero desde hace algún tiempo las cosas andan sobre ruedas. Varios dirigentes cubanos usan autos marca Geely, modelos que también utilizan las tropas automotrices de la PNR y el G2. La muy kitsch progenie cubana, incursiona en lo que cree nueva ruta y va de compras a Hong Kong, expertos en temas sociales intercambian criterios de “cambio” con cierta regularidad, empresarios de ambos países firman contratos galácticos, y delegaciones de alto nivel se visitan con tal gusto que hasta el presidente cubano le cantó a Hu Jintao en mandarín.

El nuevo negocio subrepticio es “la solidaridad” con grupos de chinos que aterrizan en la isla con la regularidad que cae el agua por tubería rota, constante y a gotas, estimulando resortes del mercado negro que mueve la bien engarzada cadena de la economía subterránea.

Algunos arrendatarios autorizados, aseguran que “los narras” son clientes muy tranquilos, no llevan jineteras a casa y apenas salen de la habitación. No hacen turismo, no van a la playa, no compran maracas ni visitan museos; toda su estancia en la isla se la pasan murmurando, y comiendo.

Tanto así que la nueva especialidad culinaria en las casas de alquiler es hacer una taza de arroz con dos y media de agua sin sal, de ahí sale una masa espantosa que luego se deja secar, se agrega curry, se hacen bolas, se empanizan y después de fritas se llaman Croquetas de arroz.

Eso les ha dado vida a vendedores ambulantes que antes vendían a domicilio flores, condones, langostas o carne de res, y hoy cumplen sus expectativas vendiendo arroz (del bolito). No es ilegal y ganan más, porque como dice el refrán “Se aprovecha la racha, cuando viene escasa”.

Pero cierto corredor de viviendas que lleva clientes extranjeros a las casas de alquiler, ex oficial de inmigración de Playa, refiriéndose al desarrollo de este lucrativo y nuevo renglón de mercado, me asegura con sarcástica ingenuidad “esto sigue igual, el gobierno se hace el que no ve y mañana dirá que no sabe; pero hasta hoy la cosa marcha y no falta el curry en las tiendas en divisas. Mira – continuó cambiando el tono mi interlocutor de voz segura y auto francés –, lo que se sabe, no se pregunta; la realidad es que estos chinos son clientes codiciados, viajan en grupos pequeños que permanecen en Cuba de 13 a 25 días; pero antes de partir, Ñijao, aquí lo importante es el cash, todo queda original y bien amarra’o, pagan hasta setecientos CUC por un pasaporte cubano, 200 por obtener un carné de identidad, y mil más por estar incluidos en las actas oficiales del registro civil correspondiente, convirtiéndose de esta manera en ciudadanos chino-cubanos debidamente legalizados. Y ya nacionalizados continúan viaje al futuro con destino al vecino mayor, listos para ser acogidos por la ley de ajuste cubano.”

El tráfico ilegal de chinos usando a Cuba como trampolín, es un negocio prohibido que por tolerado acepta cómplices, no testigos.

miércoles, marzo 20, 2013

Chinese firms dominate Cuba IT fair

lunes, febrero 11, 2013

Castro's China Bubble Burst

Another one of the recent myths regarding Castro's Cuba was that China had become a major source of financing and investment.

Another one of the recent myths regarding Castro's Cuba was that China had become a major source of financing and investment.We always held this was false, for this 2010 State Department cable (released by Wikileaks) had revealed the Chinese regime's frustrations in doing business with the Castro brothers.

Yet, that didn't stop Cuba "experts" from heralding the next year:

"In a major endorsement for Cuba’s economic reform project, the man expected to become China’s president in 2013 witnessed the signing of 13 agreements in Havana that include the billion-dollar expansion of a refinery, the extension of fresh loans, and an agreement to set a five-year cooperation plan."

Well, so much for that.

According to Reuters today, that bubble (like others before it) has burst:

"People involved in the expansion said more than two years ago China would build and finance the project, with the money backed by Venezuelan oil. But the deal has never taken wings.

Nothing has been disclosed publicly and the Chinese have been mostly silent on the matter. However, sources say China has never signed a final agreement due to questions ranging from Chavez' health to future oil and natural gas supplies to whether the project will be built by Chinese or Cuban workers.

domingo, diciembre 09, 2012

China, Raúl y la Nomenklatura

|

| Li Yuanchao, miembro del Buró Político y enviado especial |

|

| General Qi Jianguo, subjefe del Estado Mayor General |

y aqui >>

lunes, noviembre 12, 2012

La importancia de Cuba para China: 400 mil usd

|

| licpereyramele.blogspot.com |

Sandy atravesó la isla caribeña el 25 de octubre último, desde el sur de Santiago hasta el norte de Holguín, pero la fuerza de sus vientos huracanados y las intensas lluvias afectaron toda la región oriental, inundaron poblados, destruyeron cientos de miles de inmuebles y cobraron la vida de 11 personas.

La entrega simbólica de la ayuda se concretó mediante un canje de notas firmadas por Nuñez y el embajador de China en Cuba, Zhang Tuo.

La viceministra agradeció el donativo y aseguró que será incorporado a los fondos destinados a enfrentar las secuelas dejadas por el huracán.

Nuñez también resaltó la ayuda solidaria de la Cruz Roja China mediante la entrega de 50 mil dólares en efectivo, que igualmente el gobierno sumará a las ayudas enviadas desde diversas partes del mundo para ayudar a resarcir los daños causados por Sandy.

Las provincias del oriente cubano han recibido cargamentos de ayuda humanitaria de Venzuela, Ecuador, Bolivia, Rusia, Catar y República Dominicana, entre otros.

Retratos de fusilados por el Castrismo - Juan Abreu

"Hablame"

"EN TIEMPOS DIFÍCILES" - Heberto Padilla

A aquel hombre le pidieron su tiempo

para que lo juntara al tiempo de la Historia.

Le pidieron las manos,

porque para una época difícil

nada hay mejor que un par de buenas manos.

Le pidieron los ojos

que alguna vez tuvieron lágrimas

para que contemplara el lado claro

(especialmente el lado claro de la vida)

porque para el horror basta un ojo de asombro.

Le pidieron sus labios

resecos y cuarteados para afirmar,

para erigir, con cada afirmación, un sueño

(el-alto-sueño);

le pidieron las piernas

duras y nudosas

(sus viejas piernas andariegas),

porque en tiempos difíciles

¿algo hay mejor que un par de piernas

para la construcción o la trinchera?

Le pidieron el bosque que lo nutrió de niño,

con su árbol obediente.

Le pidieron el pecho, el corazón, los hombros.

Le dijeron

que eso era estrictamente necesario.

Le explicaron después

que toda esta donación resultaria inútil.

sin entregar la lengua,

porque en tiempos difíciles

nada es tan útil para atajar el odio o la mentira.

Y finalmente le rogaron

que, por favor, echase a andar,

porque en tiempos difíciles

esta es, sin duda, la prueba decisiva.

Etiquetas

ANALISIS ESPECIALES SOBRE EL NEOKAXTRIZMO

- 89,000 razones para el cambio

- Análisis del neocastrismo entre huevos con jamón y tostadas

- Aproximación a Cuba desde la Teoría del Caos ( I )

- Biología y sucesión ( 2 ): La política económica de la subsistencia

- Biología y sucesión: El Pacto de los Comandantes y el Pacto de los Generales

- Biología y sucesión: ¿A quién mejor que a la familia?

- Cuba, entre la lógica y la incertidumbre

- Cuba, entre la lógica y la incertidumbre

- Cuba: Crisis del sistema bancario o crisis del pensamiento económico

- Cuba: Las reformas y la empresa pública del Neocastrismo I

- Cuba: Las reformas y la empresa pública del neocastrismo ( II )

- Cuba: Nudos Gordianos o ¿dónde dejaron el portaaviones?

- Del Castrismo a la castracion

- Economia Politica de la Transicion en Cuba [1]

- Economía política de la transición (2): La pobreza estructural como mecanismo de dominación

- Economía política de la transición (3): Las claves de la pobreza estructural

- El Neocastrismo posible

- El Síndrome del Neocastrismo

- El Zhuanda Fangxiao cubano: mantener lo grande, deshacerse de lo pequeño/

- El caos y la logica difusa en el Castrismo

- El estado de bienestar del Neocastrismo: “Lucha tu alpiste pichón”

- El menú del neocastrismo: pato pekinés y hallacas venezolanas/ Eugenio Yáñez

- El neocastrismo: “revolución” sin ideología

- El secuestro de la Ciencia Cubana por Fidel Castro

- El ¨sucre¨: fracaso anunciado de un golpe de estado

- Elecciones en Cuba: Control Político, Manipulación y Testosterona Biranica [II]

- Elecciones en Cuba: Control Político, Manipulación y Testosterona Biranica [I]

- Estrategias medievales en el siglo XXI

- La antesala del entierro político de Fidel Castro

- La caja de Pandora del castrismo: la sucesión

- La ¨Rana Hirviendo¨ del Castrismo

- Los caminos hacia la Cuba post-castrista

- Los funerales del hombre nuevo

- Los múltiples síndromes del "Papá Estado" cubano

- Neocastrismo y Vaticano: liturgias y Vía Crucis. El camino de Tarzán

- Neocastrismo, diplomacia "revolucionaria" y wikiboberías

- Por un puñado de dólares

- Raúl Castro en el año del Dragón ( I )

- TRES AÑOS DE RAULISMO ( I I I, FINAL): Sombras nada más

- Unificación Monetaria en Cuba: Un arroz con mango neocastrista [1]

- Unificación Monetaria en Cuba: Un arroz con mango neocastrista [2]

- Unificación Monetaria en Cuba: arroz con mango neocastrista [FINAL]

- Vivienda y Castrismo. La mezcla se endurece

- ¿Perestroika a la cubana?

GLOBAL

- ChartsBin

- DEBKAfile

- Daily Planet Map

- Economist Intelligence Unit

- Estadisticas mundiales en tiempo real

- Foreign Affairs

- Fox Nation

- Fragilecologies

- Global Incident Map

- Global Security

- Human Progress

- InfoWars

- New Zeal

- NewScientist

- Power Wall

- Pulitzer Center

- Ted Ideas

- The Albert Einstein Institution

- The Blaze

- The Daily Beast

- The Global Report

- The National Security Archive

- The Peak

- Trends Research Institute

- What does it mean

- World Audit

- ZeroHedge

- ipernity

Cuba

Seguidores

Carta desde la carcel de Fidel Castro Ruz

“…después de todo, para mí la cárcel es un buen descanso, que sólo tiene de malo el que es obligatorio. Leo mucho y estudio mucho. Parece increíble, las horas pasan como si fuesen minutos y yo, que soy de temperamento intranquilo, me paso el día leyendo, apenas sin moverme para nada. La correspondencia llega normalmente…”

“…En cuanto a fumar, en estos días pasados he estado rico: una caja de tabacos H. Upman del doctor Miró Cardona, dos cajas muy buenas de mi hermano Ramón….”.

“Me voy a cenar: spaghettis con calamares, bombones italianos de postre, café acabadito de colar y después un H. Upman #4. ¿No me envidias?”.

“…Me cuidan, me cuidan un poquito entre todos. No le hacen caso a uno, siempre estoy peleando para que no me manden nada. Cuando cojo el sol por la mañana en shorts y siento el aire de mar, me parece que estoy en una playa… ¡Me van a hacer creer que estoy de vacaciones! ¿Qué diría Carlos Marx de semejantes revolucionarios?”.

Quotes

"No temas ni a la prision, ni a la pobreza, ni a la muerte. Teme al miedo" - Giacomo Leopardi

¨Por eso es muy importante, Vicky, hijo mío, que recuerdes siempre para qué sirve la cabeza: para atravesar paredes¨– Halvar de Flake [El vikingo]

"Como no me he preocupado de nacer, no me preocupo de morir" - Lorca

"Al final, no os preguntarán qué habéis sabido, sino qué habéis hecho" - Jean de Gerson

"Si queremos que todo siga como está, es necesario que todo cambie" - Giuseppe Tomasi di Lampedusa

"Todo hombre paga su grandeza con muchas pequeñeces, su victoria con muchas derrotas, su riqueza con múltiples quiebras" - Giovanni Papini

"Life is what happens while you are busy making other plans" - John Lennon

"Habla bajo, lleva siempre un gran palo y llegarás lejos" - Proverbio Africano

"No hay medicina para el miedo" - Proverbio escoces

"El supremo arte de la guerra es doblegar al enemigo sin luchar" - Sun Tzu

"You do not really understand something unless you can explain it to your grandmother" - Albert Einstein

"It is inaccurate to say I hate everything. I am strongly in favor of common sense, common honesty, and common decency. This makes me forever ineligible for public office" - H. L. Menken

"I swore never to be silent whenever and wherever human beings endure suffering and humiliation. We must always take sides. Neutrality helps the oppressor, never the victim. Silence encourages the tormentor, never the tormented" - Elie Wiesel

"Stay hungry, stay foolish" - Steve Jobs

"If you put the federal government in charge of the Sahara Desert , in five years ther'ed be a shortage of sand" - Milton Friedman

"The tragedy of modern man is not that he knows less and less about the meaning of his own life, but that it bothers him less and less" - Vaclav Havel

"No se puede controlar el resultado, pero si lo que uno haga para alcanzarlo" - Vitor Belfort [MMA Fighter]

Liborio

A la puerta de la gloria está San Pedro sentado y ve llegar a su lado a un hombre de cierta historia. No consigue hacer memoria y le pregunta con celo: ¿Quién eras allá en el suelo? Era Liborio mi nombre. Has sufrido mucho, hombre, entra, te has ganado el cielo.

Para Raul Castro

Cuba ocupa el lugar 147 entre 153 paises evaluados en "Democracia, Mercado y Transparencia 2007"

Enlaces sobre Cuba:

- ALBERTO MÜLLER

- Abicu Liberal

- Agencia de Prensa Libre Oriental

- Asociation for the study of the Cuban Economy

- Babalu blog

- Bitacora Cubana

- Centro de Estudios de la Economia Cubana

- Cine Cuba

- Conexion Cubana

- Conexion Cubana/Osvaldo

- Cuba Futuro

- Cuba Independiente

- Cuba Matinal

- Cuba Net

- Cuba Standard

- Cuba Study Group

- Cuba al Pairo

- Cuba transition project

- Cuba/ Brookings Institution

- CubaDice

- Cubanalisis

- Cubano Libre blog

- Cubanology

- DAZIBAO-Ñ-.

- El Blog del Forista 'El Compañero'

- El Republicano Liberal

- El Tono de la Voz

- Emilio Ichikawa blog

- Enrisco

- Estancia Cubana

- Esteban Casañas Lostal/ La Isla

- Estudios Económicos Cubanos

- Exilio Cubano

- Fernando Gonzalez

- Freedom for Dr. Biscet!

- Fundacion Canadiense para las Americas: Cuba

- Fundacion Lawton de Derechos Humanos

- Gaspar, El Lugareño

- Global Security

- Granma

- Guaracabuya: Organo Oficial de la Sociedad Economica de Amigos del Pais

- Humanismo y Conectividad

- Humberto Fontova

- IRI: International Republic Institute

- Ideas Ocultas

- Jinetero,... y que?

- La Finca de Sosa

- La Nueva Cuba

- La Primavera de Cuba

- La pagina del Dr. Antonio de la Cova

- Lista de blogs cubanos

- Los Miquis

- Magazine Cubano

- Manuel Diaz Martinez

- Martha Beatriz Roque Info

- Martha Colmenares

- Medicina Cubana

- Movimiento HUmanista Evolucionario Cubano

- Neoliberalismo

- Net for Cuba International

- Nueva Europa - Nueva Arabia

- Oficina Nacional de Estadisticas de Cuba

- Penultimos Dias

- Pinceladas de Cuba

- Postal de Cuba

- Real Instituto Elcano

- Repensando la rebelión cubana de 1952-1959

- Revista Hispano Cubana

- Revista Voces Voces

- Secretos de Cuba

- Sociedad Civil Venezolana

- Spanish Pundit

- SrJacques Online: A Freedom Blog

- Stratfor Global Intelligence

- TV Cuba

- The Havana Note

- The Investigative Project on Terrorism

- The Real Cuba

- The Trilateral Commission

- Union Liberal Cubana/Seccion de Economia y Finanzas

- White House

- Yo Acuso al regimen de Castro

Cuando vinieron

Cuando vinieron a buscar a los sindicalistas, Callé: yo no soy sindicalista.

Cuando vinieron a buscar a los judíos, Callé: yo no soy judío. Cuando vinieron a buscar a los católicos, Callé: yo no soy “tan católico”.

Cuando vinieron a buscarme a mí, Callé: no había quien me escuchara.

Reverendo Martin Niemöller

Articulos especiales

- * Analisis del saldo migratorio externo cubano 2001-2007

- * Anatomía de un mito: la salud pública en Cuba antes y después de 1959

- * Cuba: Sistema de acueductos y alcantarillados

- * ELECCIONES: Un millon ciento cincuenta y dos mil personas setecientas quince personas muestran su oposicion al regimen

- * El Trinquenio Amargo y la ciudad distópica: autopsia de una utopía/ Conf. del Arq. Mario Coyula

- * Estructura del PIB de Cuba 2007

- * Las dudas de nuestras propias concepciones

- * Republica y rebelion

- Analisis de los resultados de la Sherrit en Cuba

- Circulacion Monetaria: Tienen dinero los cubanos para "hacerle" frente a las medidas "aperturistas" de Raul?

- Cuba-EEUU: Los círculos viciosos y virtuosos de la transición cubana [ 3] / Lazaro Gonzalez

- Cuba-EEUU: Los círculos viciosos y virtuosos de la transición cubana [ I ]/ Lazaro Gonzalez

- Cuba-Estados Unidos: Los Círculos Viciosos y Virtuosos de la transición cubana [ I I ]- Lazaro Gonzalez

- Cuba: Comercio Exterior 2007 y tasas de cambio

- Cuba: Reporte de turistas enero 2008

- Cuba: Sondeo de precios al Mercado Informal

- Estudio de las potencialidades de la produccion de etanol en Cuba

- Reforma de la agricultura en Cuba: Angel Castro observa orgulloso al Sub-Latifundista de Biran al Mando*

- Turismo en Cuba: Un proyecto insostenible. Analisis de los principales indicadores

- Unificación Monetaria en Cuba: Un arroz con mango neocastrista [1]

CUBA LLORA Y EL MUNDO Y NOSOTROS NO ESCUCHAMOS

Donde estan los Green, los Socialdemocratas, los Ricos y los Pobres, los Con Voz y Sin Voz? Cuba llora y nadie escucha.

Donde estan el Jet Set, los Reyes y Principes, Patricios y Plebeyos? Cuba desesperada clama por solidaridad.

Donde Bob Dylan, donde Martin Luther King, donde Hollywood y sus estrellas? Donde la Middle Class democrata y conservadora, o acaso tambien liberal a ratos? Y Gandhi? Y el Dios de Todos?

Donde los Santos y Virgenes; los Dioses de Cristianos, Protestantes, Musulmanes, Budistas, Testigos de Jehova y Adventistas del Septimo Dia. Donde estan Ochun y todas las deidades del Panteon Yoruba que no acuden a nuestro llanto? Donde Juan Pablo II que no exige mas que Cuba se abra al Mundo y que el Mundo se abra a Cuba?

Que hacen ahora mismo Alberto de Monaco y el Principe Felipe que no los escuchamos? Donde Madonna, donde Angelina Jolie y sus adoptados around de world; o nos hara falta un Brando erguido en un Oscar por Cuba? Donde Sean Penn?

Donde esta la Aristocracia Obrera y los Obreros menos Aristocraticos, donde los Working Class que no estan junto a un pueblo que lanquidece, sufre y llora por la ignominia?

Que hacen ahora mismo Zapatero y Rajoy que no los escuchamos, y Harper y Dion, e Hillary y Obama; donde McCain que no los escuchamos? Y los muertos? Y los que estan muriendo? Y los que van a morir? Y los que se lanzan desesperados al mar?

Donde estan el minero cantabrico o el pescador de percebes gijonese? Los Canarios donde estan? A los africanos no los oimos, y a los australianos con su acento de hombres duros tampoco. Y aquellos chinos milenarios de Canton que fundaron raices eternas en la Isla? Y que de la Queen Elizabeth y los Lords y Gentlemen? Que hace ahora mismo el combativo Principe Harry que no lo escuchamos?

Donde los Rockefellers? Donde los Duponts? Donde Kate Moss? Donde el Presidente de la ONU? Y Solana donde esta? Y los Generales y Doctores? Y los Lam y los Fabelo, y los Sivio y los Fito Paez?

Y que de Canseco y Miñoso? Y de los veteranos de Bahia de Cochinos y de los balseros y de los recien llegados? Y Carlos Otero y Susana Perez? Y el Bola, y Pancho Cespedes? Y YO y TU?

Y todos nosotros que estamos aqui y alla rumiando frustaciones y resquemores, envidias y sinsabores; autoelogios y nostalgias, en tanto Louis Michel comulga con Perez Roque mientras Biscet y una NACION lanquidecen?

Donde Maceo, donde Marti; donde aquel Villena con su carga para matar bribones?

Cuba llora y clama y el Mundo NO ESCUCHA!!!

Suscribirse Cuba Independiente

CIF: Cuba Independiente http://CubaIndependiente.blogspot.com Registro (c) Copyright: ® DIN 189297780000 Gerente By: www.copyrightwww.com

![NEOCASTRISMO [Hacer click en la imagen]](http://4.bp.blogspot.com/_5jy0SZhMlaU/SsuPVOlq2NI/AAAAAAAAH1E/4xt2Bwd2reE/S150/ppo+saturno+jugando+con+sus+hijos.jpg)