Not all readers of this blog have been reading it consistently for the past few years, and as I read some of the comments it’s clear that many people don’t know where I’m coming from on macro issues. So it may be worth reiterating a point I’ve made before — that I’ve actually been very consistent on this stuff, and that there’s a simple model underlying almost everything I write about macro.

My view is that we had a deleveraging shock that landed us in a liquidity trap — a situation in which short-term nominal interest rates are close to zero, so that conventional monetary policy has no traction.

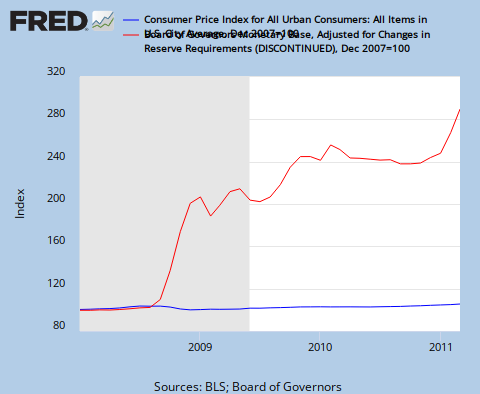

And I had worked out the implications of a liquidity trap long ago. In a liquidity trap even large increases in the monetary base aren’t inflationary; even large government deficits don’t drive up interest rates.

And so it has proved:

What’s striking to me is the way people who reject this framework keep inventing special reasons to explain why things aren’t going the way they “should” — e.g., it’s QE2 that’s holding down those interest rates, so just you wait, or the surge in commodity prices (driven by growth in emerging markets) is a harbinger of huge inflation here, never mind the flatness of wages. But as I see it, things have gone pretty much the way a model that we had before the crisis said they would.

What’s striking to me is the way people who reject this framework keep inventing special reasons to explain why things aren’t going the way they “should” — e.g., it’s QE2 that’s holding down those interest rates, so just you wait, or the surge in commodity prices (driven by growth in emerging markets) is a harbinger of huge inflation here, never mind the flatness of wages. But as I see it, things have gone pretty much the way a model that we had before the crisis said they would.

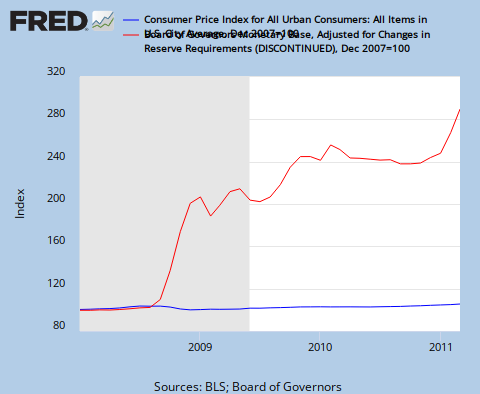

And I had worked out the implications of a liquidity trap long ago. In a liquidity trap even large increases in the monetary base aren’t inflationary; even large government deficits don’t drive up interest rates.

And so it has proved:

No hay comentarios:

Publicar un comentario